Collectibles

Discovery & MVP Strategy

Defining an MVP strategy for an AI-driven collectibles management product

Early-stage startup exploring an AI-powered platform to help collectors catalog, manage, and track the value of diverse collectible assets.

Services Provided

Market & User Research

Competitive & Category Analysis

Product Strategy & MVP Definition

The collectibles market has evolved from niche hobbyist communities into a global, multi-hundred-billion-dollar ecosystem. What was once driven primarily by passion and nostalgia is now increasingly shaped by investment behavior, price transparency, grading services, and digital resale platforms.

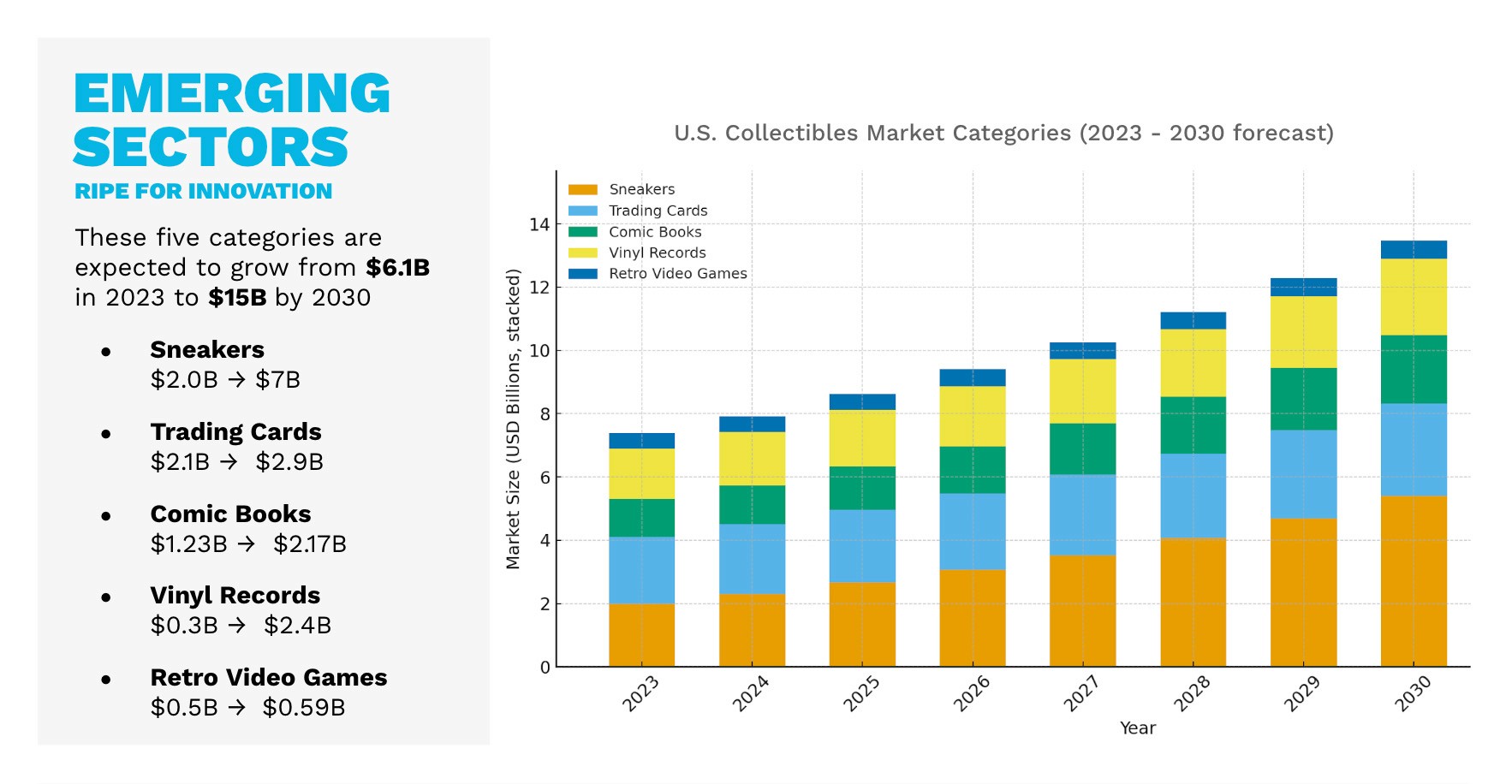

According to market analysis conducted as part of this engagement, the U.S. collectibles market generated over $62B in revenue in 2024, with projections reaching $83B by 2030, while the global market is expected to exceed $420B in the same timeframe . Growth is not limited to a single category — sneakers, trading cards, comic books, vinyl records, and retro video games all show sustained or accelerating demand.

The client was building a new application that uses AI to help users catalog, organize, and track the value of their collectibles across categories. Before committing to an MVP, the team needed clarity on where real value existed, which user types to prioritize, and how to focus limited development resources for maximum return.

The Challenge

The challenge was not validating market size — the opportunity was already clear. The real questions were strategic:

Which collector segments were most underserved by existing tools?

Which categories showed both growth and fragmentation?

What problems were shared across collectors, investors, flippers, and professional sellers?

Where could AI meaningfully improve workflows rather than add novelty?

What should the MVP include — and, just as importantly, what should it exclude?

Without a focused strategy, there was a risk of building a broad but shallow product that failed to resonate with any core audience.

Our Role

Parallel² partnered with the founding team to lead market and user research, with the explicit goal of informing product direction and MVP scope.

Our role was to:

Analyze market size, growth, and category dynamics

Identify core user types and behaviors

Surface shared and divergent pain points

Translate research insights into actionable product priorities

Rather than producing research in isolation, the work was structured to directly support decision-making.

Approach

Market & Category Analysis

We analyzed the collectibles market across major categories, including:

Sneakers

Trading cards

Comic books

Vinyl records

Retro video games

The research examined:

Historical performance

Post-COVID corrections and stabilization

Forecast growth through 2030+

The role of grading, marketplaces, and cultural drivers

This revealed a market that, while volatile in places, remains resilient and increasingly institutionalized, with secondary markets playing a central role.

User Segmentation

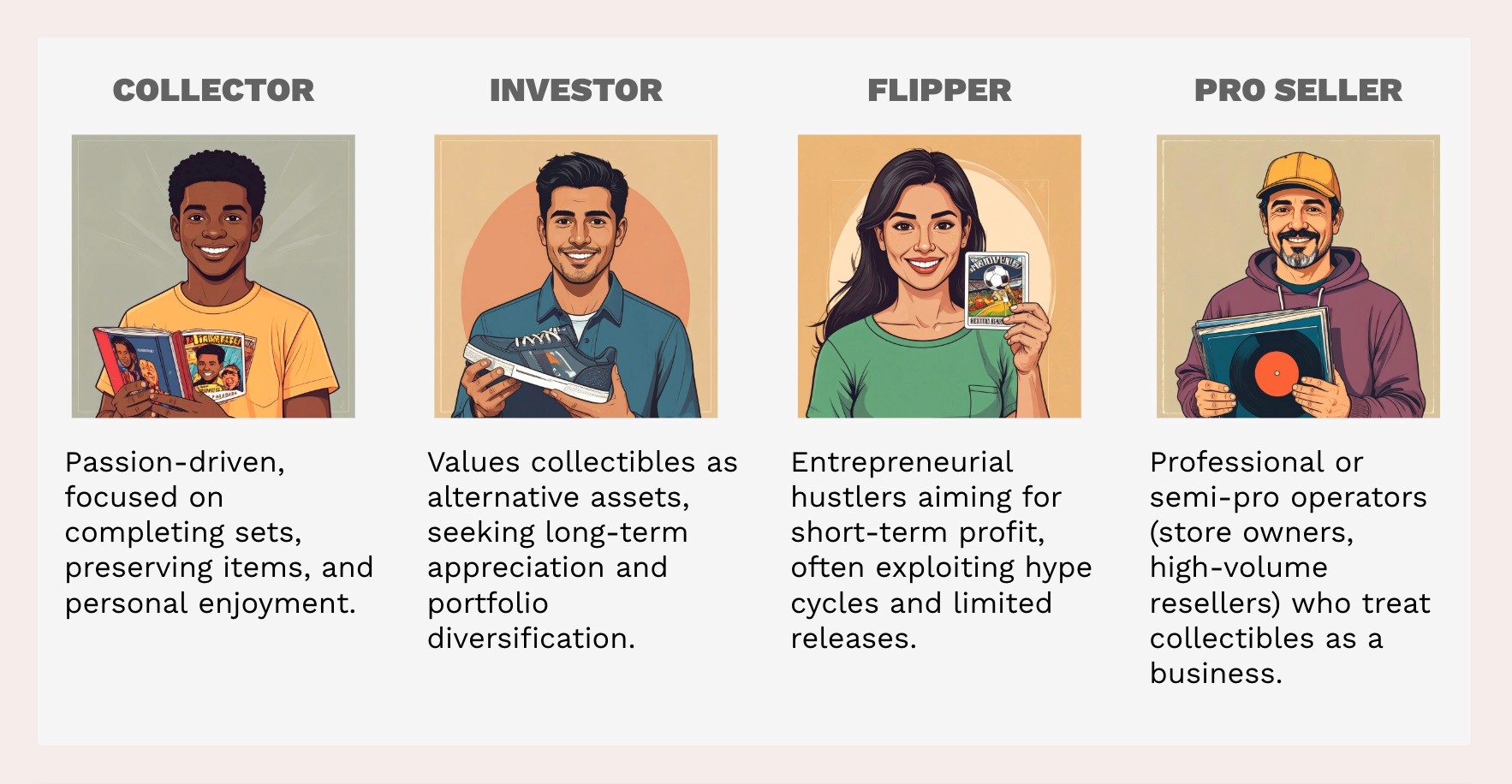

The research identified four primary user types operating across collectibles ecosystems:

Collectors — passion-driven users focused on completion, preservation, and enjoyment

Investors — users treating collectibles as alternative assets and long-term stores of value

Flippers — opportunistic buyers focused on short-term arbitrage and hype cycles

Professional Sellers — high-volume operators running resale as a business

Each group exhibited distinct motivations, behaviors, and constraints, but also shared several overlapping needs.

Pain Point & Needs Analysis

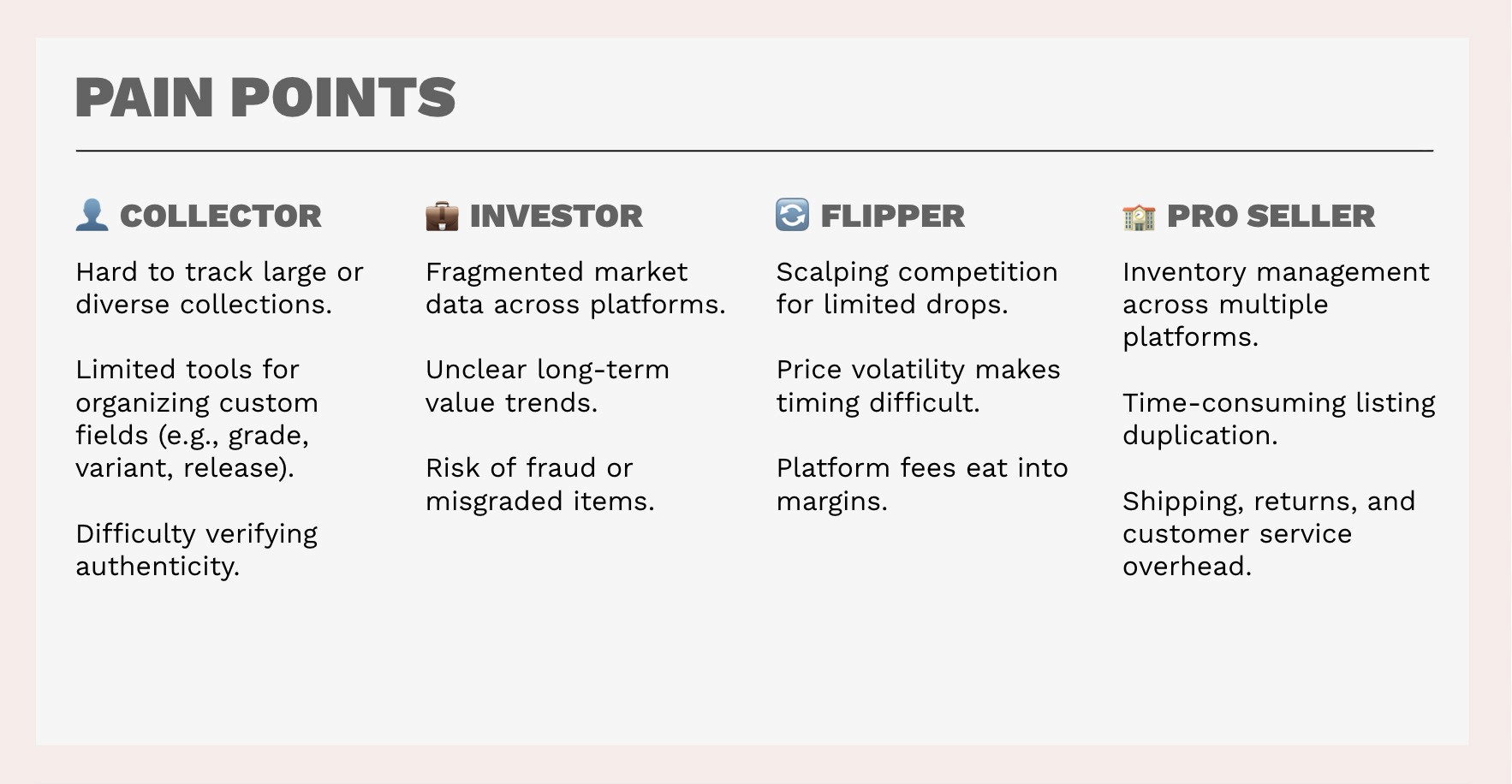

Across segments, the research surfaced consistent challenges:

Difficulty tracking large or diverse collections

Fragmented data across platforms

Limited customization for cataloging and metadata

Poor visibility into long-term value trends

Time-consuming manual processes

Professional sellers faced additional operational burdens, including inventory management, cross-platform duplication, and logistics overhead.

Key Insights

1. The market is large, but highly fragmented

Collectors rely on a patchwork of spreadsheets, niche tools, and marketplaces with no unified view.

2. Growth categories are not evenly served

Sneakers and trading cards have strong resale infrastructure, while comics, vinyl, and retro games remain underserved digitally.

3. User motivation shapes product expectations

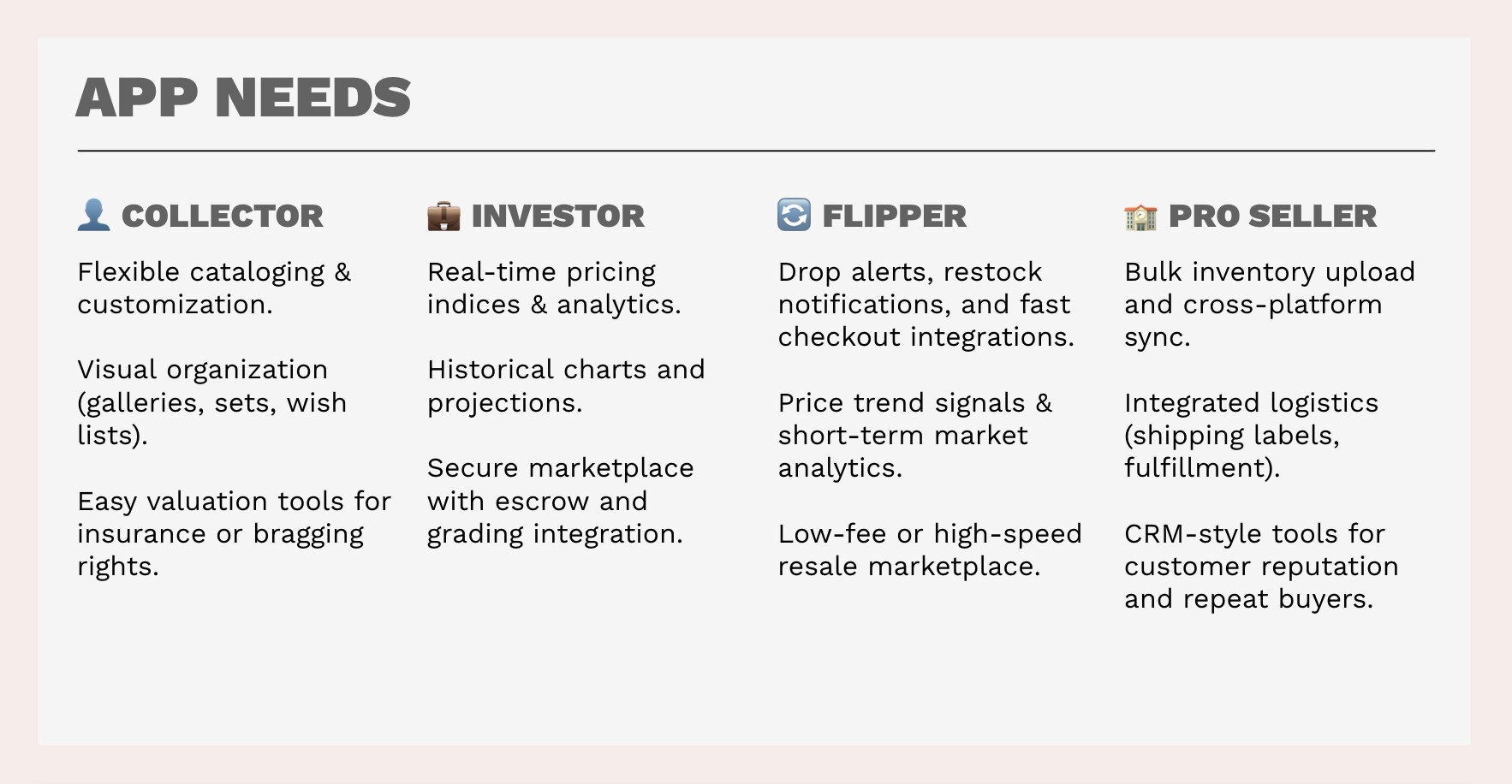

Passion-driven collectors value organization and presentation, while investors prioritize valuation and trends.

4. AI value lies in synthesis, not prediction

Users want help organizing, interpreting, and contextualizing data — not opaque “black box” forecasts.

5. MVP success depends on focus

Attempting to serve all user types equally would dilute value and slow adoption.

6. Cataloging is the universal entry point

Flexible, customizable cataloging emerged as the strongest cross-segment need.

7. Market data alone is not enough

Users struggle to translate raw pricing data into meaningful insight.

8. Trust and credibility matter across segments

Authentication, grading integration, and transparent data sources increase confidence.

Outcome

The research directly informed the company’s MVP strategy.

A sample of the research can be found here →

Key outcomes included:

Clear prioritization of core user segments for initial launch

Focus on cataloging, organization, and valuation visibility as foundational features

De-prioritization of speculative AI features in favor of practical workflows

A roadmap aligned with the highest return on development effort

Rather than building a broad, unfocused platform, the team moved forward with a clearly defined MVP designed to validate demand and scale intelligently.

The product is currently under development, grounded in the strategic clarity provided by the research.

Reflection

This engagement reinforced that strong market research is not about volume of data — it’s about reducing uncertainty.

By connecting market dynamics, user behavior, and product decisions, the research helped transform a large opportunity into a focused, executable plan.